Free GST Invoice Generator Online

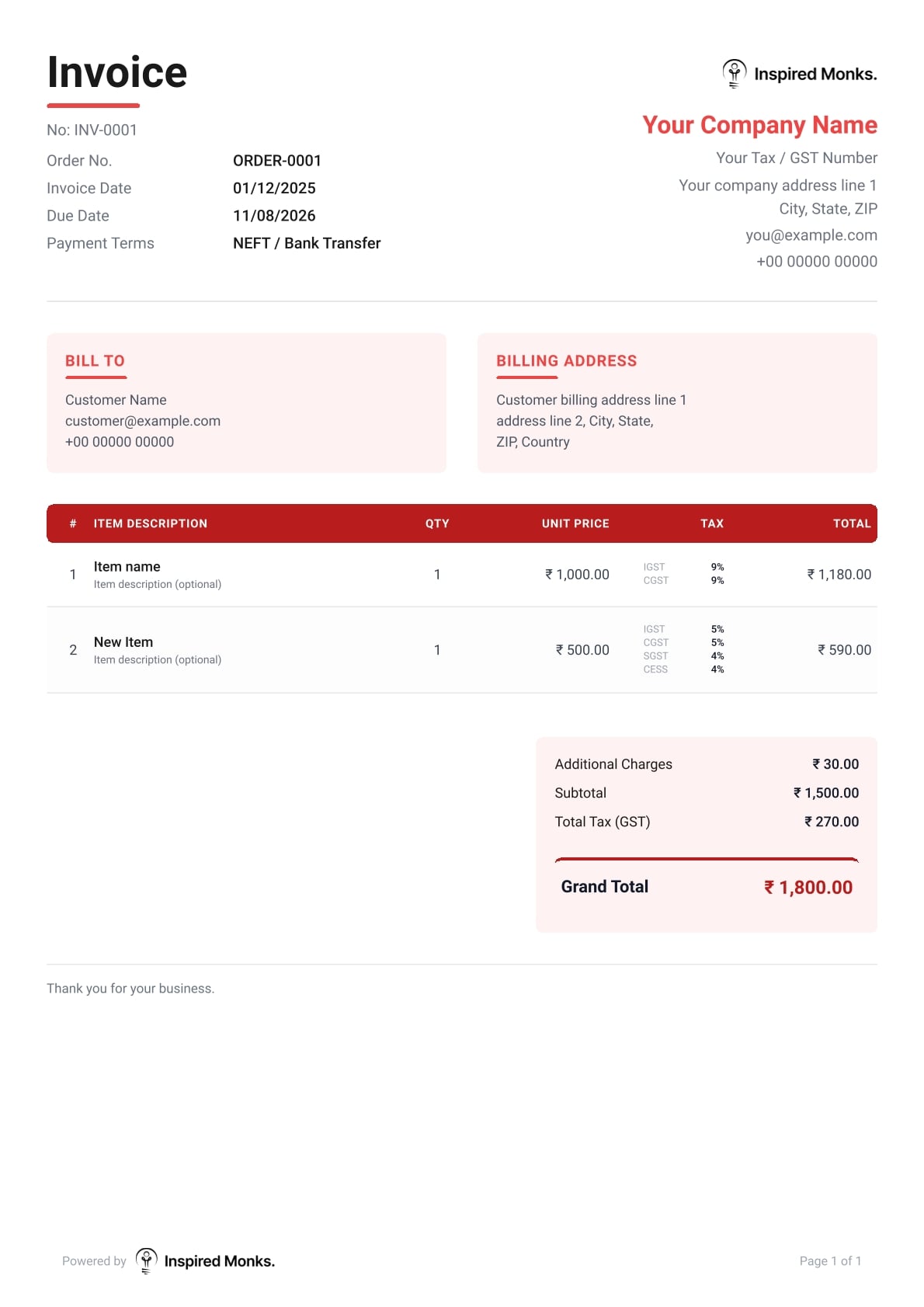

With our costless software, you can create ready-to-use GST invoices in seconds! This is specifically designed for Indian freelancers and small-to-med sized enterprises requiring fast billing that is 100% legal. No signup to create your invoice. Just enter your data into our form and click download.

Make Free Invoices That Get You Paid Faster

Benefits

Why Use Our Free Invoice Maker Tool?

It's Actually Free

India GST Compliance Built-In

Works in Any Currency

No Signup Required, 100% Private

One-Click Duplicate & Reorder

Save time with drag-and-drop item reordering and instant line duplication for recurring services.

Instant PDF Invoice Download

Create Your GST Invoice Online in 3 Easy Steps

Who's paying who

What are you charging for

Download and send

Advanced Features of Our Online Invoice Generator Free Tool

Full Branding Control

Zero-Error Automated Math

100% Client Data confidentiality

Browser Auto-Save

Flexible Line Discounts

Apply discounts directly to specific items or services. clearly showing your clients exactly how much they are saving builds trust and goodwill.

Custom Notes & Terms

Clarify how you want to be paid. Dedicated sections for bank details, payment terms (e.g., Net 30), or a simple "Thank You" note.

Frequently Asked Questions - Free GST Invoice Generator

Is this GST invoice generator really free?

Yes, you can use our GST invoice generator for free forever. Trial periods, unstated fees, or premium upgrades are not available. Create an infinite number of GST-compliant invoices without registering or paying.

Do I need to download software to use this invoice generator?

Can I create GST-compliant invoices for India?

How is this different from Zoho Invoice Generator?

Can I use this for non-GST invoices?

Yes. Simply disable the tax field to create invoices without GST. This makes it perfect for businesses under GST threshold limits or for creating proforma invoices.

Is my client data safe and private?

Can I generate invoices in currencies other than INR?

Yes. Our online invoice generator supports 150+ currencies including USD, EUR, GBP, AED, SGD, and more. The tool automatically adjusts tax labels (GST for INR, VAT for EUR/GBP, Sales Tax for USD).

Does this work as an invoice generator Excel replacement?

Yes. Stop using manual Excel sheets with formula errors. Our tool auto-calculates everything – quantities, rates, discounts, and taxes – giving you error-free invoices instantly.

Can I download the invoice as a PDF?

Yes. Click the “Download PDF” button to get a high-resolution, print-ready PDF invoice. The file is optimized for email attachments and printing.

Is this invoice generator free for commercial use?

Absolutely. Whether you’re a freelancer, small business, or enterprise, you can use our free invoice generator for unlimited commercial invoicing at no cost.

How do I add my company logo to the invoice?

Click the “Upload Logo” section at the top of the invoice template and select your PNG or JPG logo file. It will automatically resize and position your branding on the invoice.

Can I create purchase orders and receipts too?

Yes. This tool works as a free bill generator, receipt maker, and purchase order creator. Simply change the document title from “Invoice” to “Receipt” or “Purchase Order” as needed.

Complete Guide: How to Use a Free GST Invoice Generator in India

Running a business in India means dealing with GST invoicing whether you like it or not. Miss a field, enter the wrong tax type, or forget sequential numbering — and suddenly your client’s ITC claim gets rejected, or worse, you’re flagged for an audit. This guide covers everything you need to know to invoice correctly, efficiently, and for free.

What is a GST Invoice Generator?

At its core, a GST invoice generator is a browser-based tool that builds compliant invoices for you. You enter your details, it handles the calculations, formats everything neatly, and hands you a PDF ready to send or print.

The difference between this and an Excel sheet? With Excel, you’re managing formulas, checking tax splits manually, and hoping nothing breaks when you add a new row. With an online invoice generator, the math happens in the background. You focus on what you’re billing — the tool figures out what the client owes.

Quick Note

No accounting knowledge required. If you can fill out a form, you can generate a professional GST invoice.

Why Indian Businesses Need a GST-Specific Invoice Tool

Most invoice tools built for international markets miss several things that Indian GST law specifically demands. A tool built for Indian businesses needs to handle:

- GSTIN for both the seller and the buyer

- The correct tax type — IGST for interstate transactions, CGST+SGST for intrastate ones

- HSN codes for goods, SAC codes for services

- Mandatory sequential invoice numbering

- Reverse charge mechanism flag where applicable

A general-purpose invoice builder won’t know any of this. A free GST invoice generator built for India handles all of these requirements automatically — so compliance isn’t something you have to manually check. It’s already baked in.

Free GST Invoice Generator vs. Excel vs. Paid Tools

Here’s an honest look at how the three most common invoicing methods compare:

Feature | Excel Template | Zoho / Paid Tools | Free Online Generator |

Cost | Free (needs Excel license) | ₹500–₹2,000/month | ₹0 Forever |

GST Auto-Calculation | No | Yes | Yes |

Signup Required | No | Yes | No |

Mobile Friendly | Poor | Yes | Yes |

Data Privacy | Local | External cloud server | Browser only |

Instant PDF Download | Manual export | Yes | Yes |

Verdict: For freelancers and small businesses in India who want a capable free invoice generator without creating accounts or paying subscriptions, a browser-based tool is the most practical choice — hands down.

How to Create a GST Invoice: Step-by-Step

Follow these seven steps to generate a fully compliant GST invoice in minutes.

Fill In Your Business Details (Bill From)

- Your name or business name

- Full address, including your state

- Your 15-digit GSTIN

- Phone number and email address

- Company logo for branded invoices

Pro Tip

Your GSTIN’s first two digits are your state code. The tool reads this automatically to determine whether the transaction is interstate or intrastate — which directly affects how GST gets applied.

Add Your Client’s Details (Bill To)

- Client’s business name

- Full address with state

- Their GSTIN if they’re GST-registered

- Contact information

Important

Once you enter both GSTINs, the tool compares state codes. Same state — it applies CGST+SGST. Different states — it switches to IGST automatically.

Fill In the Invoice Details

- Invoice Number: Must be sequential — INV-001, INV-002, and so on. Skipping or reusing numbers creates compliance issues.

- Invoice Date: The date you’re issuing the invoice

- Due Date: Net 15, Net 30, and Net 45 are standard options

- PO Number: Only if your client sent a Purchase Order reference

List Your Products or Services

For every item you’re billing, enter the following:

- Description: Be specific. “Logo Design — Brand Identity Package” is far better than “Design Work.” Clarity reduces disputes.

- HSN/SAC Code: HSN for goods, SAC for services. Recommended even when not mandatory.

- Quantity: Units, hours, or months — whatever applies

- Rate: Your price per unit

- Discount: If you’re offering one

The invoice generator calculates every line total automatically.

Set Your GST Rate

Pick the rate that applies to your goods or services:

GST Rate | Applicable Category |

0% | Exempt goods and services |

5% | Essential goods and services |

12% | Standard rate — many goods and services |

18% | Most professional services (IT, consulting, marketing) |

28% | Luxury goods |

The tool then splits the tax correctly:

- Same state: CGST 9% + SGST 9% = 18% total

- Different states: IGST 18%

Worked example — ₹25,000 service at 18% GST (same state):

Tax Calculation Breakdown

Social Media Marketing — Monthly Retainer

Subtotal₹25,000

CGST @ 9%₹2,250

SGST @ 9%₹2,250

Total Invoice Amount₹29,500

Add Bank Details and Payment Terms

- Bank Details: Account number, IFSC code, and bank name

- Payment Terms: “Net 30 days from invoice date” — be explicit

- Notes: Thank-you message, late fee policy, or project-specific instructions

- Terms and Conditions: Optional, but useful for high-value projects

Download and Send

Click “Download PDF.” Your invoice comes out with your branding, a full breakdown of all tax components, and clean formatting that works whether it’s viewed on screen or printed. Attach it to an email or pull it into your accounting software.

GST Invoice Requirements: What the Law Requires

A GST-compliant invoice under Indian law must include all of the following:

- A unique serial number and the date of issue

- Supplier’s name, address, and GSTIN

- Recipient’s name, address, and GSTIN (when they’re registered)

- HSN code for goods or SAC code for services

- Clear description of what’s being supplied

- Quantity and unit of measure

- Total value of the supply

- Taxable value after any discounts

- Applicable tax rates and amounts split across CGST, SGST, IGST, or CESS

- Supplier’s signature or digital signature

IGST or CGST+SGST — How to Know Which Applies

Charge IGST when: you and your client are in different states, you’re exporting goods or services, or you’re supplying to an SEZ.

Charge CGST + SGST when: both you and your client are in the same state.

Example

You’re in Maharashtra (state code 27), client is in Karnataka (state code 29) — that’s interstate, so charge 18% IGST. If your client is also in Maharashtra, split it as 9% CGST + 9% SGST. The tool detects this automatically from both GSTINs.

Common Invoicing Mistakes to Avoid

1. Wrong GSTIN Entry

A single wrong digit means your client’s Input Tax Credit (ITC) claim gets denied. Always double-check every GSTIN before hitting send.

2. Non-Sequential Invoice Numbers

GST auditors check this. Gaps or duplicates in your invoice numbering series are red flags. Keep your numbering continuous with no skips.

3. Incorrect HSN/SAC Codes

Wrong classification codes can attract scrutiny from GST authorities. When uncertain, verify codes on the official GST portal before using them.

4. No Due Date Mentioned

Clients pay faster when there’s a clear deadline. Whether it’s “Due on Receipt” or “Net 30 days,” always include a due date on every invoice you send.

5. Vague Service Descriptions

“Professional Services” means nothing to an auditor or a confused client three months later. Write out exactly what was delivered and when.

Advanced Tips: Getting More from the Tool

Use It as a Free Receipt Generator

Once a client pays, retitle the document from “INVOICE” to “RECEIPT” and add: “Payment received in full on [date] via [payment method].” Simple, but legally useful.

Create Purchase Orders

When you’re the buyer rather than the seller, swap the “Bill From” and “Bill To” sections, rename the document “PURCHASE ORDER,” and send it to your supplier as a formal request.

Send Proforma Invoices

Before finalizing a project, send a proforma invoice. Change the header to “PROFORMA INVOICE” and include a validity note — for example, “Valid for 7 days.” This gives clients a confirmed quote before work begins.

Invoice International Clients

Select USD, EUR, or GBP as your currency. The tool automatically updates the currency symbol, relabels “GST” as “VAT” or “Sales Tax” based on the region, and formats numbers to international standards.

Duplicate Recurring Line Items

Got services that repeat every month? Use the duplicate button on any line item to clone it instantly rather than retyping everything each billing cycle. Ideal for ongoing retainers.

Reorder Line Items

Grab the handle icon on any row and drag it to reposition your services. Useful when you want specific line items to appear first on the invoice.

Why Skip Paid Invoicing Software?

The Cost Difference Is Real

Platforms like Zoho Invoice Generator, QuickBooks, and FreshBooks typically run ₹500 to ₹2,000 per month. That’s ₹6,000 to ₹24,000 spent annually on invoicing alone. A free online GST invoice generator cuts that cost to zero — permanently.

No Training Time

Full-featured accounting software carries a learning curve — setting up workflows, configuring tax codes, understanding dashboards. This tool works like a web form. Most people are generating invoices within a few minutes of opening it for the first time.

Your Data Doesn’t Leave Your Device

Cloud-based platforms store your client data and billing history on their own servers. This browser-based tool keeps everything in Local Storage — nothing gets uploaded anywhere. Your business data stays entirely under your control.

Works on Any Device

Desktop software locks you to one machine. The online invoice generator GST tool runs in any browser — open it on your phone, tablet, or a shared office computer and it works exactly the same.

Common Errors and How to Fix Them

Error

“Input Tax Credit Denied Due to Invalid Invoice” — Cause: Missing GSTIN, wrong tax type, or non-compliant invoice format. Fix: Ensure both GSTINs appear on every invoice. The GST invoice generator online eliminates most formatting issues automatically.

Error

“Invoice Number Already Used” — Cause: A number was accidentally duplicated. Fix: Keep a log of all issued invoice numbers and use strict sequential numbering going forward.

Error

“Client Rejected Invoice — Calculation Error” — Cause: Broken formulas in manually managed Excel files. Fix: Move to an automated free bill generator that handles all tax calculations without the risk of human error.

Legal FAQs: What You Must Know About GST Invoicing

Is a digital invoice legally valid in India?

Yes, fully. Digital invoices and e-invoices are recognized under Indian GST law. A PDF generated through a compliant tool satisfies all legal requirements.

Who needs to generate e-invoices?

Businesses with annual turnover above ₹5 crore must generate e-invoices through the GST portal. Below that threshold, standard invoices from a free GST invoice generator are completely sufficient.

How long do you need to keep invoice records?

Indian GST law requires you to maintain invoice records for at least 6 years from the end of the financial year in which they were issued.

What if I made a mistake on an issued invoice?

You cannot edit an invoice once it has been officially issued — it becomes a legal document. For reductions, raise a Credit Note. For additions, raise a Debit Note. These are the correct legal mechanisms for any post-issue corrections.

Start Invoicing the Right Way, Free

No account creation. No monthly fee. No data leaving your browser. Just a clean, reliable free online GST invoice generator that does its job every time you open it.